Chart via Kitco.is fo the period of January 7, 2000 to June 15, 2019

This chart of the historic price of copper goes back

A Look at Historical Copper Prices

But interestingly, if we take a step backwards, the long-term picture for copper prices looks quite different. In recent years, the red metal has rebounded after a downtrend from about 2011 to 2015, and over the last few decades prices have increased even more dramatically.

Case in point: as of the beginning of 2019, copper prices were up more than 200 percent since 2000. Although this major increase doesn’t account for inflation, it is still a sizeable gain. What’s more, copper prices were more or less on the rise during the latter half of the 20th century.

Subsequently, the US Geological Survey states that by July of 1998, prices “had fallen to their lowest level since the Great Depression,” while an earlier production boom in the 1980s led prices to fall on the back of resulting oversupply.

Global demand for copper is currently dominated by China, and those following the resource market will no doubt remember a large spike in Chinese demand that sent prices for copper and other commodities soaring in recent years. China is still a strong copper demand driver, and it’s been predicted that the country’s consumption of refined copper will increase by 3.2 percent in 2019.

Of course, US tariffs on China have impacted the Asian nation’s copper demand, and it’s tough to say what’s going to happen moving forward. The escalation of the trade war between the two countries has dampened prices for metals like copper, and analysts have noted that the country’s infrastructure and property sectors, both of which require large amounts of copper and other commodities, “are also showing signs of weakness.”

In addition, the Chinese government is looking to “rein in credit growth in the economy.” Some also

What’s next for copper?

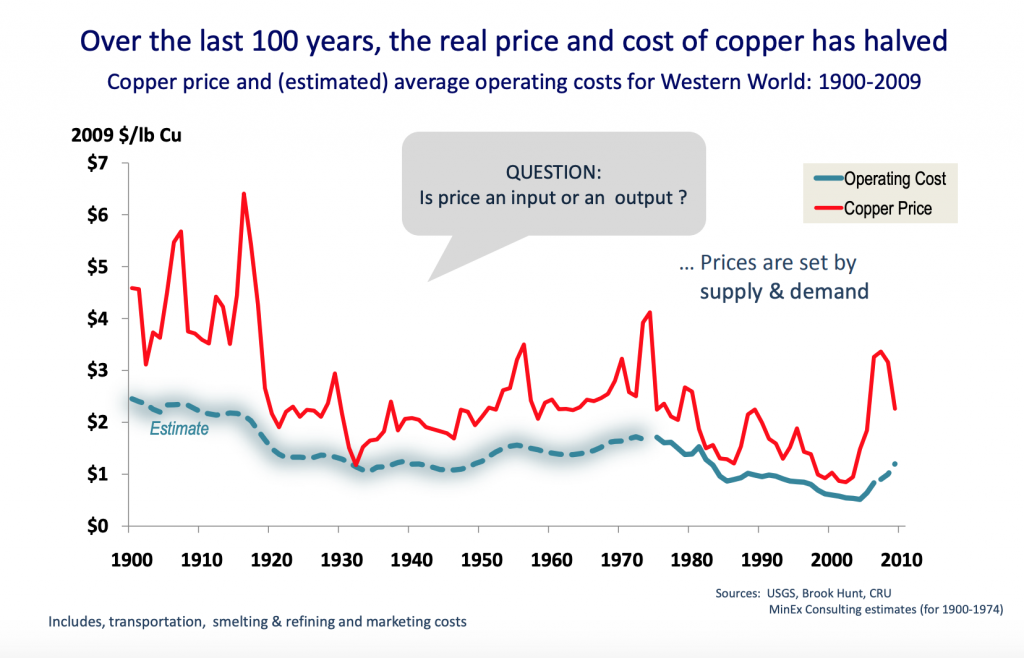

Interestingly, some take another view on the historical performance of the copper price. Richard Schodde, managing director at MinEx Consulting, gave a presentation on the subject back in 2010 that looks at a longer timeframe — 110 years to be exact. On that scale, historical copper prices have actually dropped significantly since the 1910s.Schodde told the Investing News Network by email that real copper prices have dropped about 50 percent over the past 100 years, and that production costs have also fallen due to economies of scale and advances in mining and processing technologies.

That might not sound like good news for copper, but Schodde views the drop as a good thing overall. He predicts that the industry will continue to innovate in order to exploit lower-grade deposits and meet growing global demand for copper.

Plus, it’s worth considering where you get in. Looking at the graph below from Schodde, it wouldn’t be ideal if you invested in copper back in the 1910s, but it’s more likely that investors now will have jumped in at some other point on the graph. It all comes down to strategy, timing and, frankly, a bit of luck.

Chart via MinEx Consulting.

In the short term, copper price forecasts are a bit grim due to market uncertainties created by US economic and foreign policies, including the trade war between the US and China.

However, some analysts are quite optimistic looking longer term. Ioannou said in Q4 2018, “I think as we get further out, 2021, 2022, there is definitely an argument that the idea of US$3.75 to US$4 copper is not crazy.” Ioannou was referencing prices per pound of course. So as can be seen, there is still a great deal of optimism moving forward.

Based on these historical copper prices, where do you think the red metal is headed?

This is an updated version of an article originally published by the Investing News Network in 2015.

Don’t forget to follow us @INN_Resource for more updates!

Securities Disclosure: I, Olivia Da Silva, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

No comments:

Post a Comment